Clear Blue Debt Solutions is Misleading Canadians with False Information | Wav Services Team | Review

Clear Blue Debt Solutions Inc., a Florida based debt settlement company, has a team of telemarketers calling Canadians from Melbourne, Florida. These telemarketers refer people to either Clear Blue Debt Solutions or Synergy Debt Group "Counsellors" who earn 30% commission on their sales if they meet their sales targets. These telemarketers and Counsellors are using false and very misleading information to persuade Canadians to sign up for their programs. Here are the claims that these guys are using—and even leaving on people’s voice mail:

Their Claims:

|

|

|

Clear Blue Debt Solutions Inc., clearbluedebt.ca, is Tim McCallan's Vortex Debt Group with a new name. |

|

- Claim to be a Canadian company.

- Say they have a success rate over 90%.

- Claim to be licensed to provide their services in Canada.

- Report to have an office in Toronto.

- Claim that creditors recognize them and work with them.

- State that their Counsellors are accredited.

The Facts:

Clear Blue Debt Solutions Inc. appears to be 100% American Owned & Operated

Clear Blue Debt Solutions Inc. is incorporated in the United States in state of Delaware and appears to operate out of 3270 Suntree Blvd, Suites 102A & 102B, Melbourne, FL 32940. We confirmed this with three of their employees. However, it was apparent that they are trained not to reveal this information, nor are they allowed to disclose that they use to call themselves the Vortex Debt Group.

Clear Blue Debt Solutions and the Vortex Debt Group appear to be owned by Melbourne, Florida resident, Tim McCallan, “the biggest fish to have never been caught in any regulator crackdown.” - Source of Quote

U.S.Government Says Their Success Rate is Less Than 10%

| More Helpful Information: Attorney General of New York Files Suit Against Debt Settlement Companies (good tips at the end) |

||

| Attorney General of Missouri Announces Judgment Against Clear Blue Debt Solutions' Predecessor |

||

A major U.S. government investigation revealed that all American for-profit debt settlement companies like Clear Blue Debt Solutions have a success rate that is less than 10%. So Clear Blue’s claim of a 90% success rate is the complete opposite of what the government reports to be true. A former company employee that we spoke with estimates that their actual success rate is less than 5%. Based on our extensive experience in the Canadian debt settlement industry and our research of the U.S. debt settlement industry, this makes perfect sense. – Government Source: GAO Report: Debt Settlement Fraudulent, Abusive, and Deceptive Practices Pose Risk to Consumers

Clear Blue Debt Solutions is Not Licensed in Canada

As of December 2, 2011 Clear Blue Debt Solutions is only licensed to provide their service in Alberta. Technically speaking, they don't need to be licensed in most provinces because their business model cleverly avoids licensing requirements. However, this does not help the situation. When a business goes to great lengths to avoid accountability and transparency, it raises even more questions.

Clear Blue's sister company, Synergy Debt Group, is licensed in Alberta and Ontario (as of December 2, 2011).

Their Canadian Office is Not Real

Every Clear Blue Debt Solutions employee that we have spoken with or heard from claim that they have a Canadian office—many refer to it as their Toronto office. However, on their website—and when you ask employees for details—they claim that their Canadian office is in Hamilton at the following address:

One Hunter Street, East

Ground Floor

Hamilton, ON L8N 3W1

Tel: (877) 481-9388

Clear Blue does not have a Toronto office nor do they have a Hamilton office. The Hamilton address belongs to a company that rents out “virtual offices.” This means that Clear Blue gets a mail box plus a receptionist who will answer their phone number using their company name and then transfer all calls to their Florida call center. The receptionist does this for dozens of companies who rent mail boxes using that same address. In fact as of July 17 seven debt settlement companies were using the same Hamilton address as Clear Blue Debt Solutions.

The unfortunate thing is that Clear Blue employees insist that their Canadian office is a real office with real Clear Blue Debt Solutions employees even though none of their employees have ever worked there or have ever spoken with a company employee who works there.

|

|

Clear Blue Debt Solutions' office at 3270 Suntree Blvd, Melbourne, Florida. All of their |

Many Creditors Refuse to Work with Clear Blue Debt Solutions

It’s unfortunate that Clear Blue Debt Solutions claims that all creditors work with them when this is clearly not true. Many companies refused to work with them when they operated as the Vortex Debt Group. Now that they are operating as Clear Blue Debt Solutions creditors' opinions of the company do not appear to have changed.

Counsellor Accreditation is Misleading

As of December 2, 2011, Clear Blue Debt Solutions’ Counsellors do not appear to be accredited by any Canadian organization. Instead they claim that their Counsellors are certified through the International Association of Professional Debt Arbitrators (IAPDA). According to the IAPDA company search "Clear Blue Debt Solutions" does not have any staff certified with the IAPDA. However, the Vortex Debt Group does. So any Clear Blue Debt Solutions employees who are certified received their certification as employees of the Vortex Debt Group.

Clear Blue Debt Solutions is Really the Vortex Debt Group & Wav Services Team

Clear Blue Debt Solutions is the new face of the Vortex Debt Group, a Florida based debt settlement company. After CBC news revealed that Vortex was taking people’s money and leaving them with more debt and no service, Vortex seemed to have ceased operations in Canada. However, they are now back as two new companies: Clear Blue Debt Solutions and Synergy Debt Group. A former employee with a guilty conscience tipped us off. We then investigated by calling both companies.

|

|

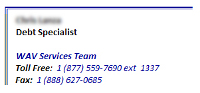

| The email signatures of Clear Blue Debt Solutions and Synergy Debt Group "Counsellors" don't mention either of these companies. Instead they indicate that these people work for WAV Services Team which we are told is Wave Group Marketing. | |

Current and former employees of both Clear Blue Debt Solutions and Synergy Debt Group confirmed for us that Tim McCallan is the owner of both companies plus the company that is running things behind the scenes, Wave Group Marketing.

Attorney General Bans Clear Blue Debt Solutions’ Predecessor for “Deceptive and Unfair” Practices

The Attorney General for the state of Missouri banned the Vortex Debt Group (now Clear Blue Debt Solutions) from the state and ordered them to refund all fees that were paid by their clients. In explaining their decision, the Attorney General’s Office stated, the "Vortex Debt Group engaged in deceptive and unfair practices by promising to reduce consumers' debt, taking significant fees from consumers in exchange for this claimed service, and failing to actually reduce consumers' debts. This often left consumers with more debt and less money.” – Source: Attorney General's Office from the state of Missouri

Colorado's Attorney General also canceled and revoked the Vortex Debt Group's license on July 1, 2011. Source: Colorado Attorney General's Website

Clear Blue Debt Solutions’ Canadian Business Practices are Called “Fraudulent, Abusive, and Deceptive” by the U.S. Government

It is now illegal in the U.S for debt settlement companies like Clear Blue Debt Solutions to charge their clients fees before providing them with a service (a negotiated debt settlement). After the U.S. government received hundreds of thousands of complaints about for-profit debt settlement companies, they investigated the debt settlement industry and found that 65% of these companies’ clients never received any service after paying their monthly fees, and when they did receive service, these companies efforts were unsuccessful more than 90% of the time. - Source: GAO Report: Debt Settlement Fraudulent, Abusive, and Deceptive Practices Pose Risk to Consumers

When speaking about for-profit debt settlement companies like Clear Blue Debt Solutions the U.S. Federal Trade Commission Chairman Jon Leibowitz concluded, "Too many of these companies pick the last dollar out of consumers’ pockets – and far from leaving them better off, push them deeper into debt, even bankruptcy.” – Source: FTC government website

The Better Business Bureau Warns Canadians about Clear Blue Debt Solutions’ Predecessor

In February 2011 the Vancouver Better Business Bureau (BBB) warned Canadians about dealing with the Vortex Debt Group. In the U.S., Vortex has an F rating with the Better Business Bureau—the worst rating possible on a scale of A+ to F—after the BBB received numerous complaints.

Clear Blue Debt Solutions Charges Excessive Fees

A former client of Clear Blue Debt Solutions provided us with a copy of his contract with this company. In the agreement, it clearly discloses the fees that the client will be charged. When you add up all the fees, they amount to the company keeping 100% of the client’s first monthly payment plus 75% of the client’s next 17 monthly payments. These fees are so excessive that we believe they call the company’s legitimacy into question. We cannot see how a company can claim to help people when it is keeping 75% of their monthly payments in fees. In the debt settlement business, this puts their clients at tremendous risk.

Almost all for-profit debt settlement companies like Clear Blue Debt Solutions tell their clients to stop paying their creditors and instead save their money so that they can save up enough for the debt settlement company to offer settlements to the client’s creditors. Clear Blue Debt Solutions’ contract, however, states that they do not tell their clients to stop making payments to their creditors while they are on the company’s debt settlement program. This is no doubt confusing for their clients since most of them are probably seeking help because they can’t afford their current monthly payments. How are Clear Blue’s clients supposed to continue making their payments plus pay a similar amount to Clear Blue each month? Where is this money supposed to come from—the client's credit cards or line of credit? It is clear that this program doesn’t work and only enriches the owners of Clear Blue Debt Solutions.

If someone manages to sticks with a debt settlement program like this for many months and doesn’t continue to make their monthly payments on their debts, their creditors will likely escalate their collection activities. These actives can include hiring a more aggressive collection agency, taking the client to court, getting a judgment against the client, and then either garnishing the client’s wages or putting a lien on their home.

How to Find a Reputable Debt Settlement or Debt Relief Company

If you would like to find a reputable organization to help you explore all of your options to get your debt under control (including a debt settlement) and create a plan eliminate your debt, we suggest that you contact an organization that meets all of the following criteria:

- A non-profit organization. A registered charitable society that does not exist to profit off of people or pay its Counsellors commission or incentives based on the number of people that they sign up onto a certain program.

- An accredited member of a recognized Canadian credit counselling association. You can find an accredited agency here.

- An accredited member of the Better Business Bureau in good standing.

Related Topics:

- How We Approach Debt Settlements: How Our Debt Settlement Services Work

- Is a Debt Settlement Program the Best Option for Me?

- The Dangers of a For-Profit Debt Settlement Program: How it Can Hurt You

- Debt Settlement Tips: Avoid these Debt Settlement Company Tricks

been taken

dont get caught up in this they have taken 6 month of my wifes money and have done nothing for her , she is now lost and all has from them is 300 in which she has invested in them over $1900 , how can a company live with themselves,

something needs to be done , someone needs to get them legally out of this business,,,

been taken

OMG, i have been taken too. They took more $6000 from me and suddenly they said..the dont do business again in alberta. They refunded my money only for $1900. I called and their respond was..the 4100 was for the negotiation fee. What negotiatiion fee?? cus they did not make any negotiations. What a scam!!

Sounds illegal

Debt settlements which require substantial fees to be paid up front have been illegal in Alberta for years. If you signed up for a debt settlement program like this as a resident of Alberta, then the service that you were sold was likely against the law. You should contact Service Alberta at http://www.servicealberta.gov.ab.ca/contact.cfm and report what happened to you. You may want to file a formal complaint with them, and then contact this company and insist that this they refund you every penny. If their actions were illegal, then they should not be profiting off of them.

Is this the same Tim Mccallan

Is this the same Tim Mccallan who was part of allegro law in Alabama?

It would appear to be the same guy

It would appear to be the same guy: https://getoutofdebt.org/29048/is-clear-blue-debt-solutions-in-canada-really-run-by-tim-mccallan-and-americorp